Introduction

The Second Payment Services Directive (PSD2) represents a significant shift towards open banking, challenging traditional banks and fintech alike to adapt swiftly. At the core of this adaptation is the need for robust compliance strategies - particularly in data handling, security, and third-party integration.

The PSD2 Compliance Challenge

PSD2 has set the stage for a new banking and financial services era, mandating unprecedented access to consumer bank accounts for third-party providers (TPPs). This directive aims to enhance consumer protection and innovation and level the playing field between banks, fintechs, and big tech companies. However, the path to compliance is fraught with technological and operational hurdles, from implementing strong customer authentication (SCA) to standardizing APIs for account access.

Why Starlify Is the Key to Unlocking PSD2 Compliance

Integration Discovery and Data Mapping

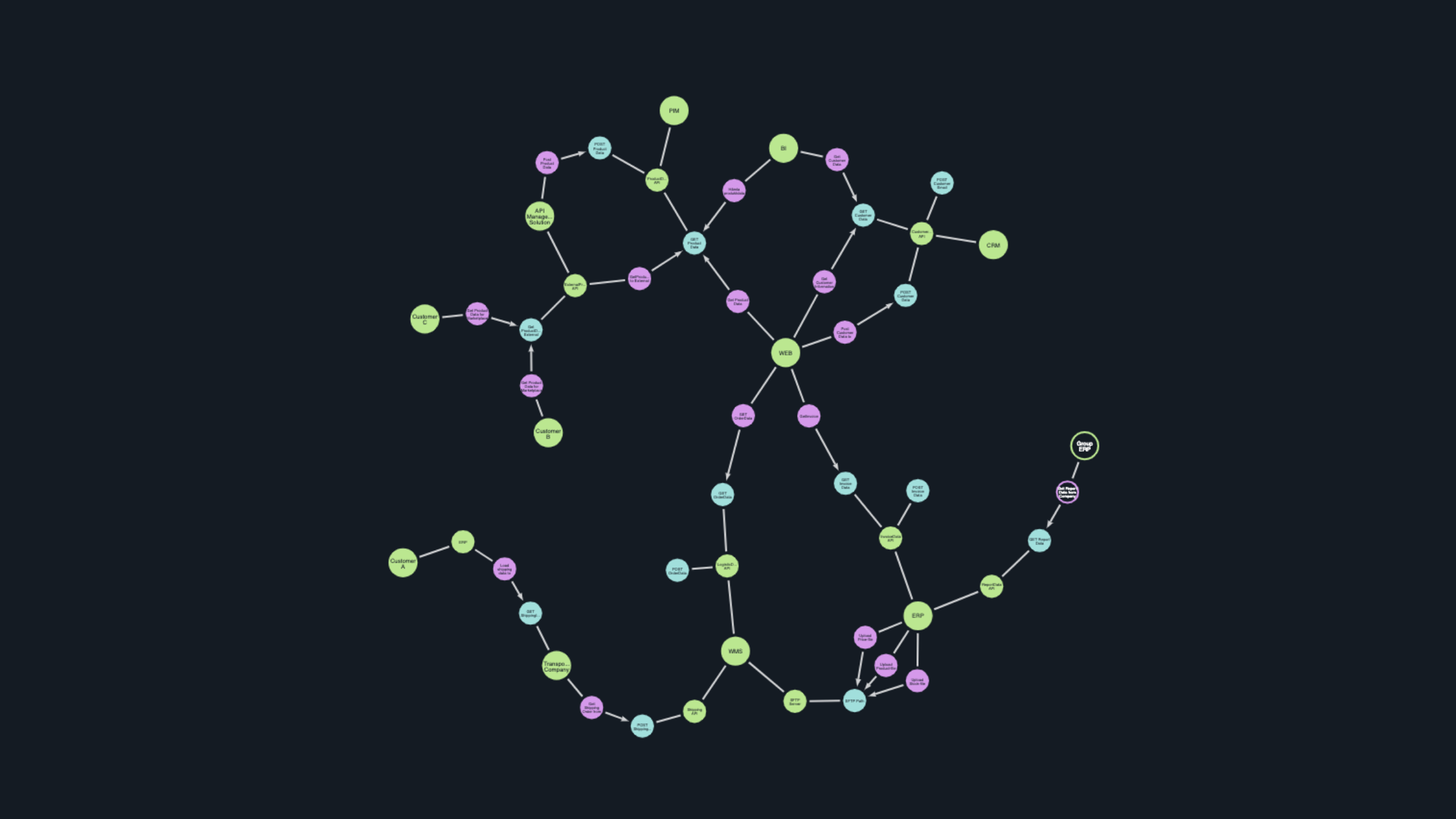

Starlify shines in its ability to facilitate comprehensive integration discovery and data mapping. By visualizing the current state of an institution's application network and mapping out the target state required for PSD2 compliance, Starlify enables a clear understanding of the necessary changes. This visibility is crucial for identifying gaps in the current integration landscape and devising a strategic plan to bridge them.

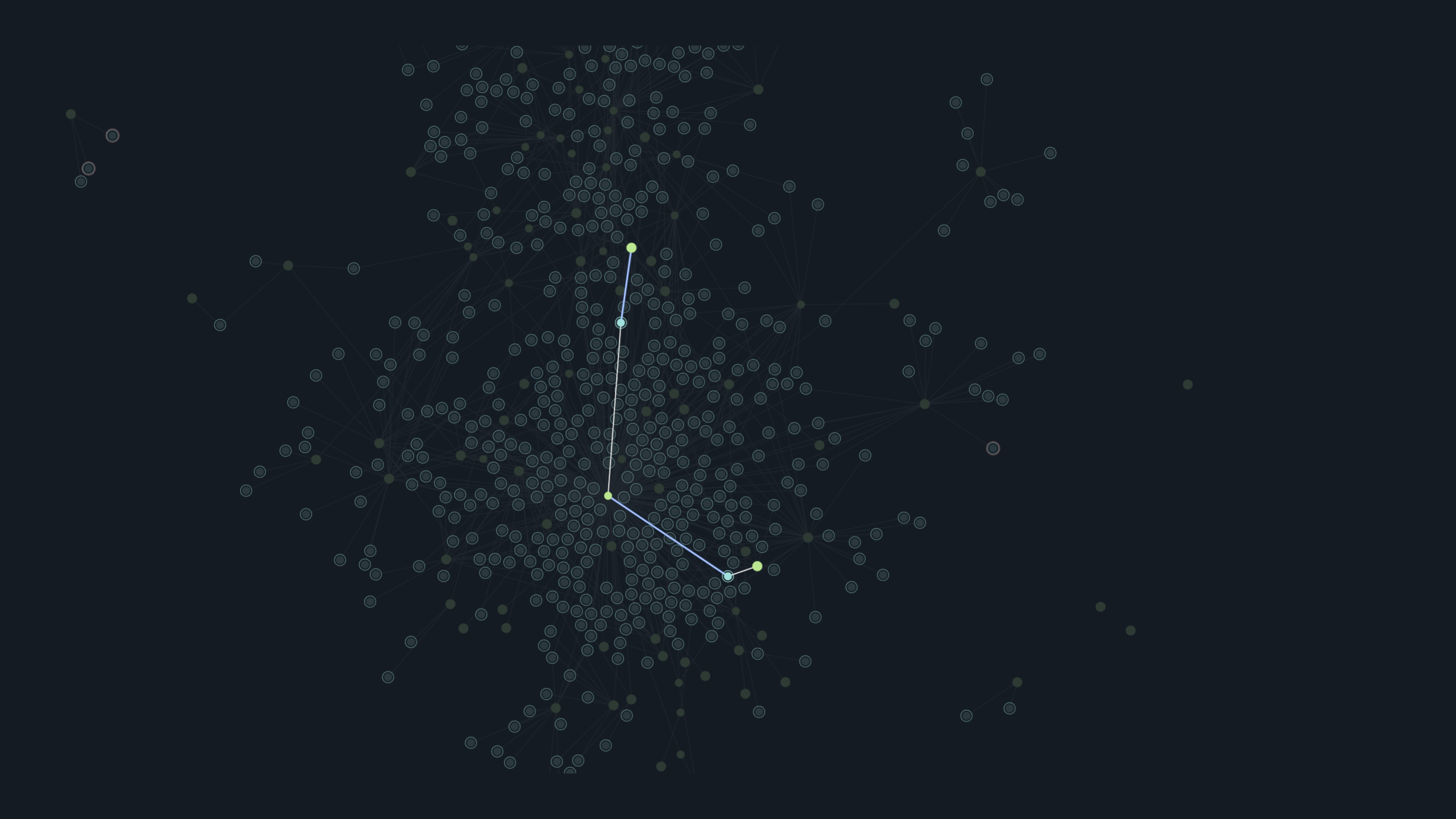

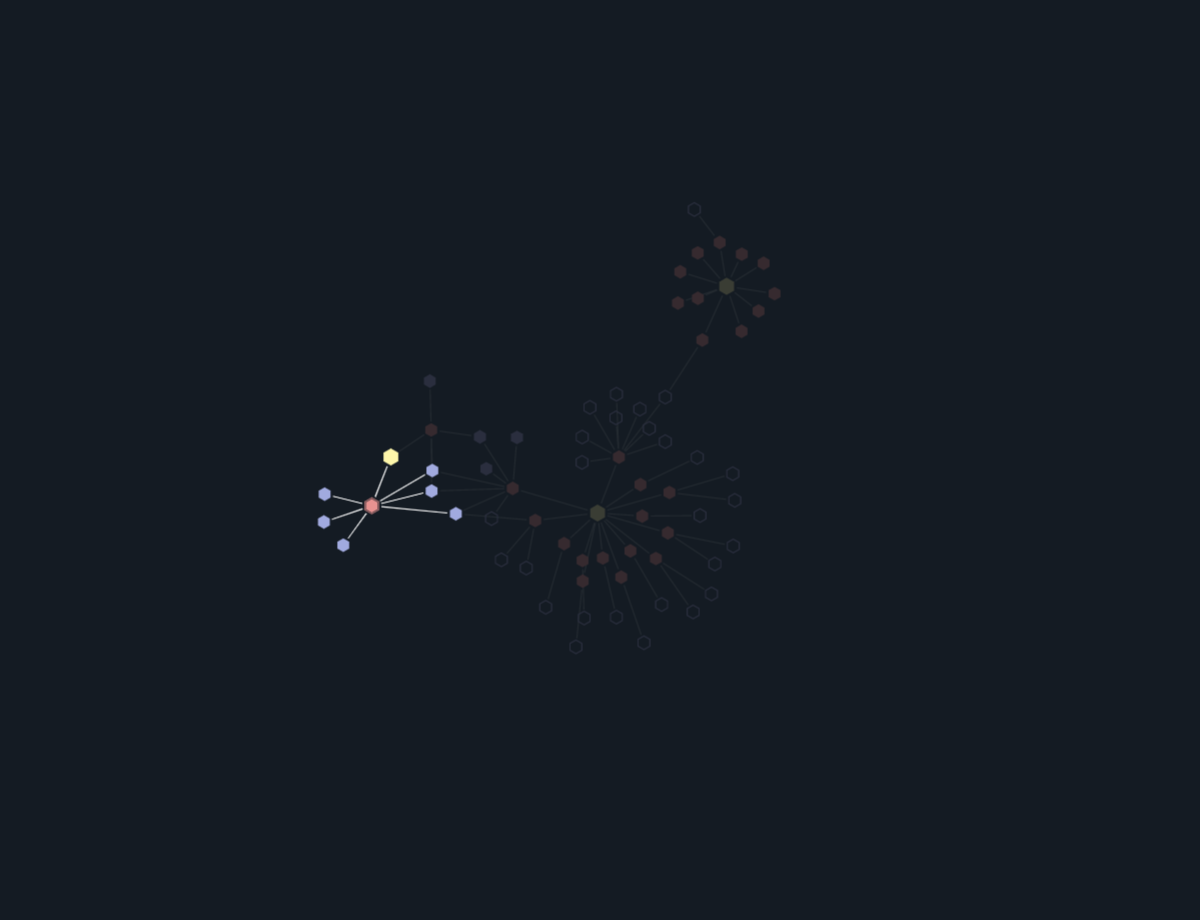

Visualization and Understanding Dependencies

One of the standout features of Starlify is its sophisticated visualization capabilities. It allows financial institutions to see their application networks' intricate web of dependencies. This insight is invaluable for assessing the impact of changes, ensuring that every adjustment made for PSD2 compliance strengthens rather than jeopardizes the network's integrity.

Collaboration and Knowledge Transfer

Achieving PSD2 compliance is a collaborative effort. Starlify fosters collaboration within the organization and with external partners, ensuring that knowledge and expertise are leveraged effectively. Through visualization, Starlify facilitates a common understanding among IT, compliance, security, and business strategy teams, enhancing communication and ensuring that every stakeholder aligns with the compliance objectives.

Facilitating Change Work for Future Compliance

PSD2 is only the beginning. The regulatory landscape for financial services is continuously evolving. Starlify's dynamic tools for data mapping, visualization, and dependency tracking make it easier for institutions to adapt their application networks for future compliance requirements. By documenting every step of the integration and compliance journey, Starlify ensures that institutions are not reacting to changes but are prepared to evolve proactively.

Conclusion

In the quest for PSD2 compliance, financial institutions face the dual challenge of meeting rigorous regulatory standards while staying agile in a competitive landscape. Starlify offers a comprehensive solution that addresses these challenges head-on, providing the tools needed for strategic planning, operational efficiency, and future-proofing against regulatory changes. By leveraging Starlify's capabilities in data mapping, visualization, and application network management, banks and fintechs can navigate the complexities of PSD2 compliance with confidence, ensuring they are not just compliant but also primed for the opportunities of open banking.

FAQs

How does Starlify help with PSD2 compliance?

Starlify aids in PSD2 compliance through comprehensive integration discovery, data mapping, visualization of application networks, and strategic planning for rapid deployment and future regulatory challenges.

Can Starlify adapt to future changes in financial regulations?

Yes, Starlify is designed to be adaptive and forward-looking, enabling financial institutions to adjust their application networks and compliance strategies as regulatory landscapes evolve.

Is Starlify suitable for all sizes of financial institutions?

Absolutely. Starlify's scalable solutions cater to the needs of various financial institutions, from small fintech startups to large, established banks, ensuring everyone can achieve and maintain PSD2 compliance.